-

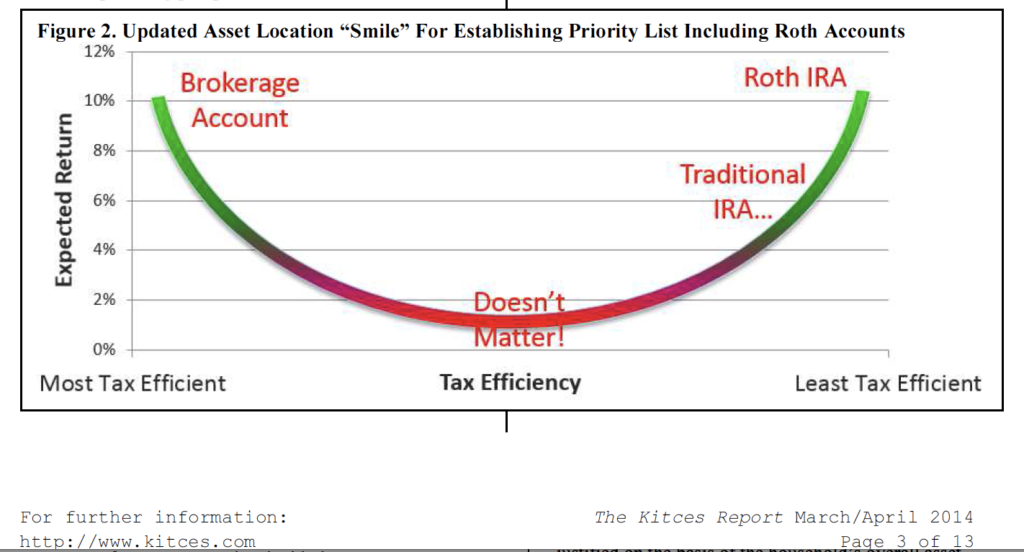

Many investors segregate accounts based on their investment goals with resulting equity-heavy retirement accounts and municipal bond-centric taxable accounts. Although psychologically comforting, this type of mix wastes much of the tax benefits of tax-deferred accounts (and the benefits of tax loss harvesting described earlier). A far more tax efficient strategy allocates higher income generating assets, especially those taxed at the full taxable income rate like bonds, to the tax-deferred accounts. This also allows us to often avoid lower yielding municipal bonds. Vanguard found that allocating tax-inefficient assets to tax-advantaged accounts can contribute up to 75 basis points in additional after-tax returns.

Roth IRAs, on the other hand, benefit from the higher expected return of equities or high yield as investors can make withdrawals tax free and low returning cash substitutes don’t have much of an impact either way. Michael Kitces graphed these conclusions into a simple smile which are shared below.

At the margin, we also prefer placing higher dividend paying stocks in tax-deferred accounts, with the exception of some American Depository Receipts (ADRs). Although ADRs are an effective way to invest overseas, many countries take out withholding taxes from dividends. France, for example, takes out 30% of the gross dividend. In taxable accounts, investors can claim credit for the payment, but if the ADR is held in a tax-deferred account, the withholding tax is lost. Although we prefer to hold high dividend paying stocks in tax-deferred accounts, if the withholding tax is high enough, we often place higher dividend paying ADRs in taxable accounts.